Top 10 Best Forex Cards in India

Using your regular credit card while spending in another country can be costly because most credit cards charge an extra fee (around 3.5%) for payments in foreign currencies. This is called a forex markup fee. To avoid this extra cost, many people use forex cards when they travel. A forex card works like a prepaid card, you add money to the card before your trip and then use it to pay, just like a debit or credit card. Most forex cards also support multiple currencies, so you can add more than one at a time. If you spend in a currency that’s already loaded on the card, you don’t have to pay any extra fees.

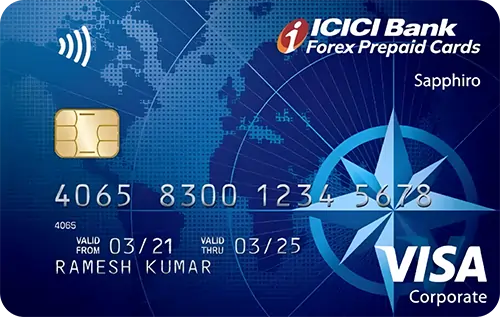

Choosing the right forex card depends on how often you travel. If you don’t travel much, a simple and low-cost card like the SBI Multi-Currency Foreign Travel Card (which has a small joining fee) might be a good option. But if you travel more often or fly with a certain airline, a premium or co-branded forex card can be better. Cards like the HDFC Regalia ForexPlus or ICICI Sapphiro Forex Card let you use different currencies without extra charges. Some cards also offer rewards when you spend, especially if they’re linked to travel platforms like Goibibo or airlines like Air Vistara. Picking the right forex card can help you save money and enjoy extra benefits while traveling abroad.

List of 10 Best Forex Cards in India

We've listed some top forex cards from various banks in India. These cards come with extra perks like free airport lounge access, insurance cover, and special discounts. Take a look at their details to find the one that works best for you.