Best Axis Bank Credit Cards

Axis Bank is one of India’s top banks, offering a variety of financial services, including credit cards. It has grown into one of the leading credit card providers in the country, with over 1.44 crore credit cards issued as of June 2024. Axis Bank offers different types of credit cards to match various lifestyles and spending habits. Whether you love shopping, watching movies, or traveling frequently, there is a suitable Axis Bank credit card for you. These cards come with several benefits, such as discounts on shopping and dining, free movie tickets, airport lounge access, and fuel surcharge waivers. Some cards also provide cashback on online purchases, making everyday spending more rewarding. No matter what your financial needs are, Axis Bank has a credit card that can help manage expenses while enjoying great perks. If you're looking for the Best Axis Bank Credit Cards, there are many options to explore.

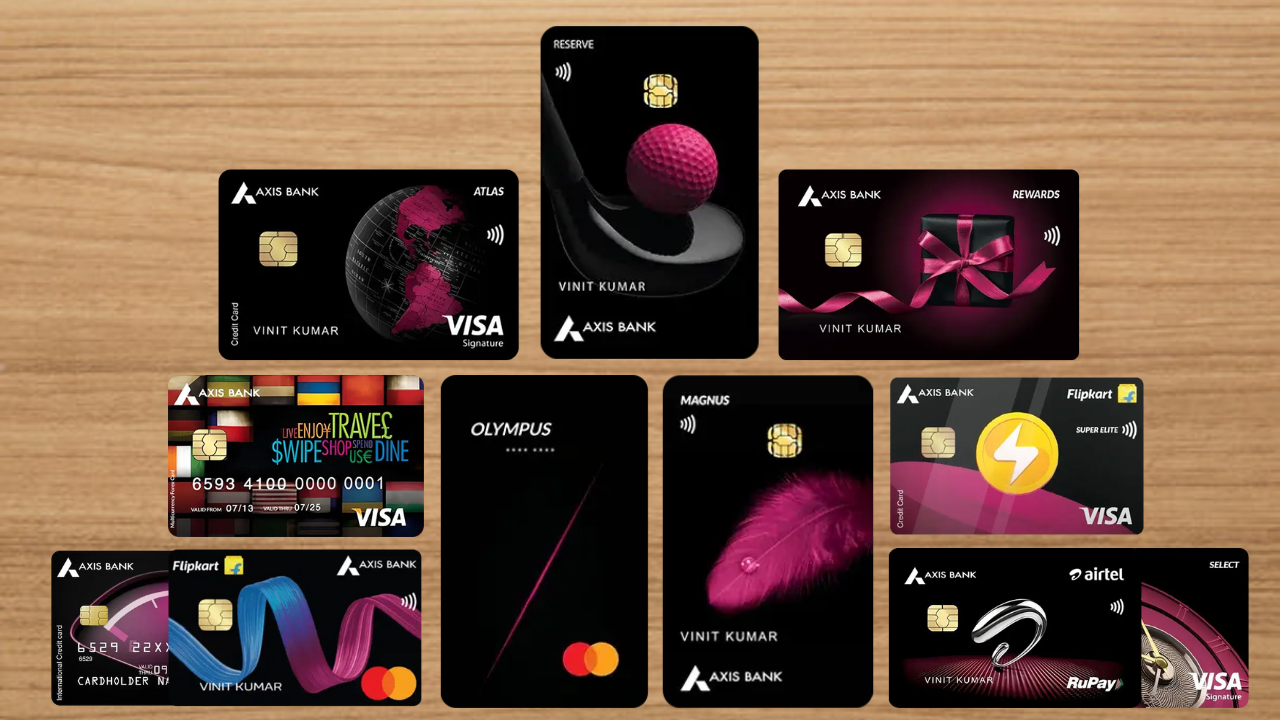

With so many choices available, selecting the right credit card can be overwhelming. This article will help by providing details on the Best Axis Bank Credit Cards, so you can easily compare their features and benefits. Some of the most popular cards include the Flipkart Axis Credit Card, which offers great cashback on shopping, and the Axis Ace Credit Card, which provides high cashback on utility bills and online spending. The Axis Select Credit Card is designed for premium users, offering travel and lifestyle benefits, while the Axis Horizon Credit Card is a good choice for those looking for a balance of rewards and savings. To make the best decision, it’s important to explore all the Best Axis Bank Credit Cards available and find the one that matches your spending habits. Check out the latest options and apply today!

List of Best Axis Bank Credit Cards in India

Axis Bank is a top credit card provider in India, offering a variety of options for different needs. Whether you want a premium card with extra perks or a simple one for daily use, there’s a suitable choice. In this article, we’ve covered some of the Best Axis Bank Credit Cards with their features and benefits. Keep reading to find the Best Axis Bank Credit Cards for you!

Axis Bank Credit Cards: Key Highlights and Advantages

Axis Bank Credit Cards come with a variety of exclusive benefits. Here’s what you can look forward to:

- Welcome Benefits: Many Axis Bank Credit Cards offer special perks for new users, including bonus reward points, extra cashback, complimentary subscriptions to premium services, exciting gift vouchers, and more. These benefits are typically unlocked after paying the joining fee or activating the card.

- Travel Privileges: Axis Bank provides several travel-centric credit cards featuring perks like complimentary access to airport lounges, chauffeured rides, discounts on flight and hotel bookings, free air tickets, hotel stay vouchers, and more.

- Milestone Rewards: Upon reaching a certain spending threshold within a specified period, you can unlock additional benefits like extra reward points, gift vouchers, and other exciting rewards.

- Rewards & Cashback: Most Axis Bank credit cards earn Edge Reward Points, which can be redeemed for various offers through the Edge Rewards program. Some cards also provide cashback or Airmiles as an alternative to reward points.

- Entertainment & Dining Offers: Selected Axis Bank Credit Cards provide exclusive deals, such as Buy One Get One Free on movie tickets and discounts at top dining outlets.

- Additional Perks: Other advantages include fuel surcharge waivers, complimentary insurance coverage, annual fee waivers based on spending, and more.

Eligibility Requirements for Axis Bank Credit Cards

To increase the chances of approval, it's crucial to check the eligibility criteria before applying for an Axis Bank Credit Card. These conditions may vary based on factors like age, income, and credit score. The general eligibility requirements include:

- Age must be between 18 and 70 years.

- The applicant should have a stable income, whether salaried or self-employed.

- A good credit score is typically required, except for secured credit cards.

Documents Required

Applying for an Axis Bank Credit Card requires submitting identity, address, and income proof. Here’s a list of essential documents:

| Identity Proof | Address Proof | Income Proof |

|---|---|---|

| PAN Card | Passport | Latest salary slips (for salaried individuals) |

| Form 60 | Driving License | ITR/Form 16 (for self-employed individuals) |

How to Apply for an Axis Bank Credit Card?

You can apply for an Axis Bank Credit Card through both online and offline methods:

- Offline Application: Visit the nearest Axis Bank branch, fill out the credit card application form, and submit the required documents.

- Online Application

- Click on ‘Apply Now.’

- You’ll be redirected to the official online application page.

- Provide your details, such as mobile number, PAN Card, and annual income.

- The system will display credit card options that match your eligibility.

- Select your preferred credit card and proceed with the application.

Checking Your Axis Bank Credit Card Application Status

If you've applied for an Axis Bank Credit Card, you can easily track its status. Simply enter your application ID and date of birth, and you'll see the latest update on your screen. If you prefer an alternative method, you can visit your nearest Axis Bank branch or contact customer care for an update on your application.

How to Activate Your Axis Bank Credit Card?

Once you receive your Axis Bank Credit Card, you must activate it before use. There are multiple ways to do this, both online and offline:

- Internet Banking: Log in to your Axis Bank net banking account. If your card is already linked, just set spending limits to activate it. Otherwise, use the activation code sent with your card.

- Customer Care: Call Axis Bank’s support team, and they’ll assist you in activating your credit card.

- ATM Activation: Visit an Axis Bank ATM, select the credit card activation option from the main menu, and follow the instructions.

- Bank Branch: If none of the above methods work, visit your nearest Axis Bank branch for activation assistance.

Logging into Axis Bank Credit Card Net Banking

Axis Bank offers a net banking platform to manage your credit card online. Follow these steps to register:

- Go to the official Axis Bank website.

- Click on the login button and select ‘Register.’

- Enter your customer ID or registered mobile number.

- Provide the required details and submit the form to complete registration.

Once registered, you can log in anytime to track transactions, pay bills, and manage your card settings.

Axis Bank Credit Card Customer Support

If you have any questions or issues with your Axis Bank Credit Card, you can contact customer support using the following options:

- Call Support: Dial 1860-419-5555 or 1860-500-5555 to speak with a representative.

- Email Support: If you prefer writing, you can send an email via the support section on the Axis Bank website.