Best ICICI Bank Credit Cards

ICICI Bank, founded in 1994 in Vadodara, is India’s second-largest private sector bank, following HDFC in revenue and market value. Originally established by the Industrial Credit and Investment Corporation of India (ICICI) in 1954, the company later rebranded and merged into ICICI Bank. A pioneer in digital banking, ICICI was the first bank in India to introduce Internet banking in 1998. Today, millions of customers across the country rely on ICICI Bank Credit Cards for their financial needs. As of September 2024, the bank has issued over 1.75 crore active credit cards, making it one of the largest credit card issuers in India. With a strong market presence, ICICI Bank continues to expand its services, attracting new customers with its diverse range of credit card offerings.

Offering cards for various spending needs, ICICI Bank Credit Cards cater to travel, shopping, dining, and entertainment categories. Recently, the bank introduced the ICICI Rewards Program, enabling cardholders to earn valuable reward points on transactions. From entry-level to super-premium cards, ICICI ensures options for all customer segments. One of its most popular no-annual-fee cards, the Amazon Pay ICICI Bank Credit Card, has gained immense popularity in India for its cashback benefits. With so many choices available, selecting the right ICICI Bank Credit Card can enhance spending while providing great value. However, responsible usage is essential to maximize benefits and avoid unnecessary financial burdens.

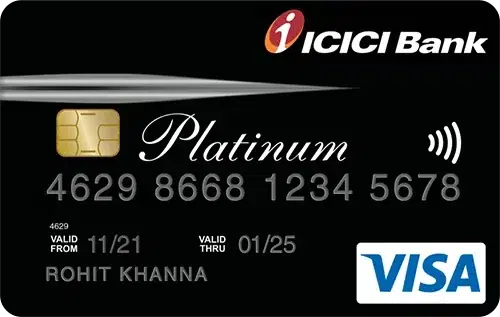

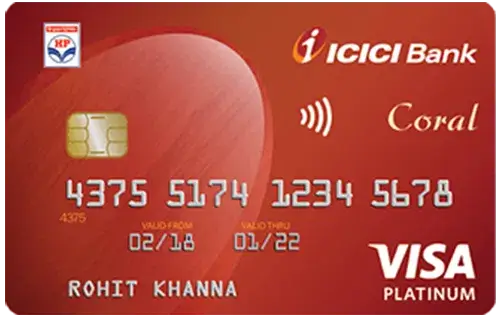

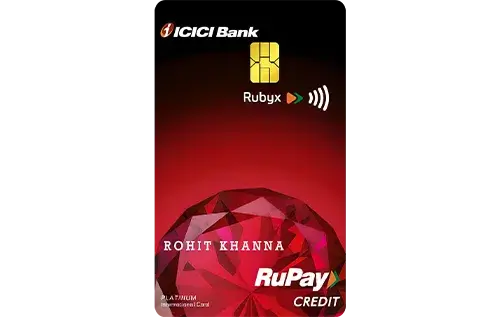

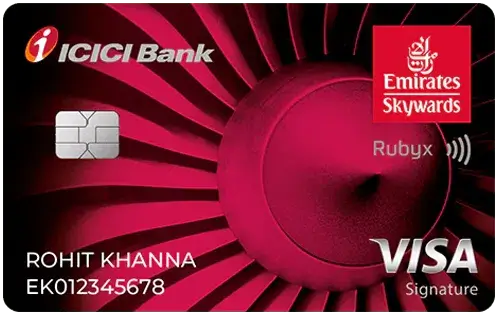

List of Best ICICI Bank Credit Cards in India

With numerous ICICI Bank credit card options available, it can be challenging to review all the features and benefits each card offers. To assist you in making an informed decision, we have compiled a list of the best ICICI Bank credit cards available in India. This will allow you to quickly explore the options and apply for the card that best suits your needs based on its features and benefits.

ICICI Credit Card Features & Benefits

ICICI Bank offers a variety of credit cards to match different needs like travel, shopping, entertainment, and more. Here are some key benefits you can enjoy:

- Welcome Benefits: When you get an ICICI Bank Credit Card, you may receive special perks like bonus reward points, free memberships, cashback, or gift vouchers. These are usually given after paying the joining fee (if applicable).

- Travel Benefits: ICICI Bank has travel credit cards that offer perks like free airport lounge access, discounts on flights and hotels, and more.

- Rewards & Cashback: Many ICICI Bank Credit Cards let you earn reward points on every purchase. Some also offer cashback, intermiles, or other loyalty rewards. You can redeem these points for different benefits.

- Milestone Rewards: If you spend a certain amount within a set period, you can earn extra perks like gift vouchers, bonus reward points, or free memberships.

- Other Benefits: Additional perks include free movie tickets, dining discounts, fuel surcharge waivers, and complimentary insurance coverage.

How to Apply for an ICICI Bank Credit Card?

You can apply online or offline.

- Offline Application: Visit an ICICI Bank branch with your documents and fill out a form.

- Online Application:

- Visit the ICICI Bank website and go to the credit cards section.

- Select the card that suits you.

- Submit the required documents.

- The bank will review your application.

- If approved, your credit card will be sent to your registered address.

Eligibility Requirements for ICICI Bank Credit Cards

ICICI Bank offers various credit cards for shopping, travel, lifestyle, and cashback rewards. To apply, you must meet these criteria:

- Age: Primary cardholder (21-65 years); Add-on cardholder (18+ years)

- Income: Salaried individuals need a minimum monthly income (varies by card type); self-employed individuals require a minimum annual income based on ITR

- Credit Score: A good score (750+) improves approval chances

- Employment: Salaried applicants must work in a reputed organization; self-employed applicants need a stable business and consistent income

- Residential Status: Open to Indian citizens & NRIs, with valid address proof (Aadhaar, Passport, or Utility Bills)

- Documents Required: Identity Proof includes PAN Card, Aadhaar, or Passport; Address Proof can be Aadhaar, Voter ID, or a Utility Bill; and Income Proof requires Salary Slips, Bank Statements, or ITR.

- Additional Factors: Existing ICICI Bank customers may get pre-approved offers. Premium cards may require higher income or a fixed deposit

How to Check Your ICICI Credit Card Application Status

You can track your application online by entering the required details on the ICICI Bank website. You can also call customer care for updates.

How to Activate Your ICICI Bank Credit Card

After receiving your credit card, activate it using any of these methods:

- Net Banking: Log in to your ICICI account, go to ‘Credit Cards,’ and select ‘Generate Credit Card PIN Online.’

- Customer Support: Call ICICI Credit Card customer care for assistance.

- ATM Activation: Visit an ICICI Bank ATM and activate your card using OTP.

- Bank Branch: Visit your nearest ICICI Bank branch for help.

How to Choose the Best ICICI Credit Card

To find the right credit card, check where you spend the most. Compare different cards based on rewards, fees, and perks. Pick the one that gives you the best benefits at the lowest cost.