Best Co-branded Credit Cards in India

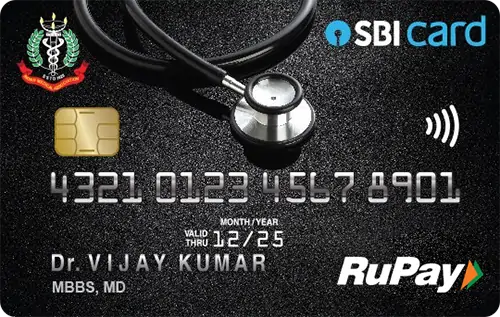

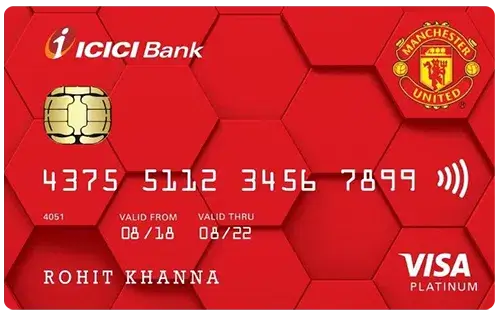

Co-branded credit cards are a popular financial product offered through a partnership between a credit card issuer (usually a bank) and a well-known brand such as an airline, hotel chain, retail store, or fuel company. These cards combine the benefits of both the brand and the financial institution, offering users exclusive perks, discounts, and reward points tailored to their spending habits. A co-branded credit card carries the name and logo of both the financial institution and the brand partner. For example, you might see cards like "HDFC Bank IRCTC RuPay Credit Card" or "Axis Bank Vistara Signature Credit Card." These cards are designed for users who frequently interact with a specific brand—like shopping at a particular store, booking travel with a certain airline, or staying at a hotel chain.

Key Features of Co-branded Credit Cards

- Brand-specific Rewards: Co-branded credit cards are designed to offer enhanced reward structures when you make purchases with the partner brand. For example, if the card is co-branded with an airline or a retail chain, you can earn significantly higher reward points or cashback when shopping or booking directly with that brand. These cards are ideal for loyal customers of specific brands, as they maximize the value of every transaction made within the brand ecosystem.

- Exclusive Discounts: Cardholders often enjoy special privileges such as exclusive discounts, limited-time offers, or early access to sales at partner brand outlets, websites, or apps. These deals are tailored to the co-branded partner and can include perks like festival sales, clearance events, or member-only pricing. This feature helps users save more while shopping frequently with their preferred brands.

- Loyalty Program Integration: One of the major benefits of co-branded cards is the integration with the partner's loyalty program. The reward points you earn through card usage can usually be transferred or converted into loyalty program benefits such as airline miles, hotel points, or store credits. This makes it easier for users to accumulate rewards faster and redeem them for travel, stays, or future purchases.

- Complimentary Benefits: To enhance user experience, many co-branded credit cards come with complimentary lifestyle benefits. These may include free access to airport lounges, complimentary hotel stays, priority check-ins at airports or hotels, and fuel surcharge waivers. Such features are especially valuable for frequent travelers or regular users of specific services, adding convenience and luxury to routine spending.

- Welcome Bonuses: Co-branded credit cards often come with attractive sign-up offers. These welcome bonuses may include bonus reward points, discount vouchers for the partner brand, free subscription to premium services, or annual fee waivers for the first year. These upfront benefits make the card appealing right from the start, especially for users who plan to use it frequently with the partner brand.

Who Should Consider a Co-branded Card?

- Frequent Travelers: If you often fly with the same airline or stay at the same hotel chain, a co-branded travel card can help. You can get benefits like free flights, lounge access, and discounts on hotel bookings.

- Loyal Shoppers: Do you shop regularly on websites like Amazon, Flipkart, or at stores like Big Bazaar or Reliance? A co-branded card for these places can give you extra discounts, cashback, and reward points.

- Fuel Spenders: If you spend a lot on petrol or diesel, a co-branded card from HPCL, BPCL, or IOCL can save you money. You may get cashback, fuel surcharge waivers, and reward points.

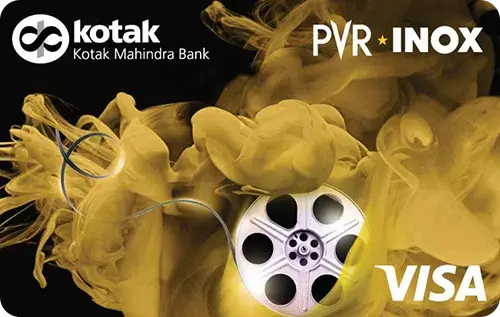

- Lifestyle Users: Love dining out, watching movies, or shopping for clothes? Co-branded lifestyle cards can offer deals like movie ticket offers, restaurant discounts, and shopping rewards.

List of Best Co-branded Credit Cards in India

Co-branded credit cards are an excellent choice if you are loyal to a particular brand and want to make the most of your everyday spending. They can offer unbeatable value, provided you align the card benefits with your lifestyle and needs.